For one reason or another, I had several calls last year with attorneys and others regarding IRS Streamlined Filing Compliance Procedure submissions gone wrong. In most cases, it was evident that the tax professional had been unaware of the particular requirements associated with this IRS program or simply fell asleep at the wheel. Regrettably, the damage to the taxpayers involved was both avoidable and gut-wrenching: the taxpayer had lost the advantages of the program and had been assessed with a litany of civil penalties. After prolonged discussions regarding options, the conversations seemed to always turn to whether the taxpayer had a potential malpractice claim against the tax professional who prepared the submission.

Given the requirements of the IRS’s Streamlined Filing Compliance Procedures, I can see how this probably happens to many taxpayers. Although the program is deceptively simple, the IRS’s Streamlined Compliance Procedure program no doubt has several nuances to it. Moreover, a lot of these issues may be coming to the surface now as the IRS has warned for years that it intends to crack down on inappropriate submissions by reviewing them more carefully, particularly the non-willful narrative.

Because these issues seem to be more and more common, I though it appropriate to share some of the more common mistakes I have seen in my practice. This article also touches on issues of professional malpractice—a potentially valuable remedy for taxpayers who have been wronged by tax professionals who committed malpractice during the representation and submission.

Background of the IRS’s Streamlined Filing Compliance Procedures

A quick background of the IRS’s Streamlined Filing Compliance Procedures is necessary before venturing more into the fray. First, the program has been around for some time now. Specifically, the IRS initiated it in late 2012. Since that time, the IRS has broadened its scope by permitting both U.S. persons physically present in the United States and U.S. persons located overseas to participate in the program.

Because there are technically two programs—one for U.S. persons physically outside the United States for specific amounts of time and one for all others—it is important to recognize that each has its own requirements. For example, the domestic offshore procedures require the taxpayer to have previously filed U.S. tax returns for each of the most recent three years in which a return was due. Moreover, the foreign offshore procedures—unlike the domestic offshore procedures—have no miscellaneous Title 26 penalty, which is discussed more fully below.

However, the two programs do have one significant commonality: both require the taxpayer to assert under penalties of perjury that the conduct at issue (i.e., the non-reporting and non-payment of taxes) was non-willful.

Common Traps in a Streamlined Filing Compliance Procedure Submission

- Misidentifying Willful vs. Non-Willful Conduct

Perhaps the most common trap for the unwary tax professional is the critical distinction between willful and non-willful conduct. This distinction is important because only taxpayers who meet the non-willful criteria are permitted into the IRS’s Streamlined Filing Compliance Procedures. Indeed, the IRS has another program, the Voluntary Disclosure Program (VDP), that was established for taxpayers to come into compliance if their conduct was willful.

Because the penalties for a streamlined submission are generally much less than those imposed under the VDP, taxpayers will often try to convince their tax professionals that their conduct was non-willful. Moreover, even without the increased penalties, taxpayers seem to interpret the term “willful” to only mean deliberate or intentional conduct. Tax professionals should be careful here: no doubt they have an obligation to advocate for their client; however, they also have a duty to ensure that the facts support a submission to the IRS that the conduct was, in fact, non-willful.

Because the determination of whether conduct was willful or non-willful turns on the particular facts and circumstances of any given case, tax professionals must ensure that they review all relevant documents and have robust discussions with their clients regarding the non-compliance issues. Although there will always be some doubt, tax professionals should recognize that the determination as to whether a taxpayer’s conduct was willful or non-willful depends largely on federal case law—i.e., this determination is a legal determination, weighing all risks to the taxpayer.

The final determination is not made easy by the various standards that the federal courts utilize in analyzing whether a taxpayer was willful. Generally, federal courts have found willfulness if any of the three following standards are met.

First, a taxpayer may be willful if the taxpayer violates a known legal duty. Thus, a taxpayer can be found in violation of this standard if the taxpayer knew about the various filing obligations and reporting requirements and simply failed to comply with them. No doubt, this definition is the definition thought of by many taxpayers when they speak to their tax professionals and argue that they were not willful. However, many taxpayers are unaware that they can nevertheless be found as willful under two other, lesser-known standards.

The second standard for willfulness is whether the taxpayer acted recklessly in violating a legal duty. Generally, federal courts have analyzed this standard by looking at whether the conduct at issue resulted in an unjustifiably high risk of harm that would be obvious or known. Under this standard, the courts look at not whether the person knew of the reporting obligation but rather whether they should have known. In many cases, these determinations are based on the amount involved, the taxpayer’s professional and business care, and other factors.

The third standard for willfulness is whether the taxpayer acted with so-called willful blindness.” This concept—borrowed from criminal law—looks at whether the person made conscious efforts to avoid learning about the reporting obligations. Commonly, this is referred to as “hiding your head in the sand.” In many cases, the IRS will argue to federal courts that a taxpayer acted either recklessly or with willful blindness in failing to report foreign accounts and marking the boxes “no” on Schedule B regarding interests in foreign accounts.

Given the three standards above, it is critical for taxpayers and tax professionals to engage in honest discussions regarding the actions that resulted in their non-compliance. For example, our firm reviews relevant documents and other information, which is followed by extensive interviews with the taxpayer to ensure that we have identified risks and properly advised the taxpayer. After reviewing relevant documents and engaging in these discussions, tax professionals should speak to their clients about the various programs available, which may include an alternative submission under the IRS’s Voluntary Disclosure Program (VDP). Indeed, in many cases, after review of the information and the taxpayer’s answers, the better route may be to abandon the streamlined submission in favor of the VDP to better protect the taxpayer from criminal exposure.

- Failure to Properly Complete the Streamlined Narrative

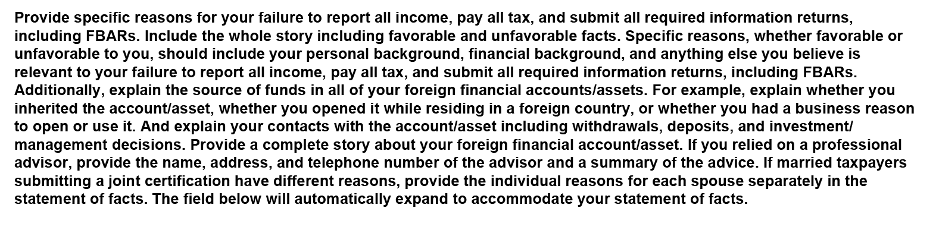

The IRS Streamlined Compliance Procedures require taxpayers to submit certain IRS forms with the submission. The form depends on the submission. For taxpayers who make a domestic offshore submission, the form is Form 14654, Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures. For taxpayers who make a foreign offshore submission, the form is Form 14653, Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures. Both forms require a narrative from the taxpayer regarding the non-willful conduct. A snapshot of the instructions for IRS Form 14653 is below.

When completing the narrative, there are at least two important considerations. First, a streamlined submission to the IRS is only valid if the taxpayer has made a complete and truthful narrative to the IRS. If the IRS later discovers that information was omitted, the IRS can boot the taxpayer from the program and impose all relevant penalties. Moreover, the IRS can refer the taxpayer’s case and non-complete narrative to the DOJ or a United States Attorney for criminal prosecution. To send a message, the IRS has made more criminal referrals on this basis in recent years.

Second, to have a complete and truthful narrative, the taxpayer must answer all the questions above that precede the narrative. Significantly, this includes providing the IRS with both “good” and “bad” facts regarding the noncompliance, i.e., the non-reporting and non-payment of tax. Good tax professionals have the experience and skill to highlight the good facts and minimize the more harmful facts.

In addition to favorable and unfavorable facts, the taxpayer must also provide the following information: (i) explain the source of the funds in the account; (ii) explain all contacts with the accounts; and (iii) to the extent the taxpayer contends he or she relied on a tax professional, provide the name, address, and telephone number in addition to the summary of advice. This information is not optional—it must be provided to the IRS, where applicable, to constitute a sufficient submission. A failure to provide the information may result in the entire submission being flagged, and the taxpayer being removed from the program.

Taxpayers should recognize that the IRS is requesting this information for a reason. First, the IRS wants to know about the sources of the funds and any contacts to better determine whether there are willful factors. Second, the IRS wants the tax advisor’s contact information in the event the submission is reviewed. The IRS has learned that, in many cases, the tax professional may have a different side of the story regarding advice provided (and in some cases, even a copy of a questionnaire that asked whether the taxpayer had foreign accounts).

- Not Filing All Required Information Returns

Another common mistake is to make the submission without all the required information returns. Admittedly, there are many, and these are easy to miss. However, taxpayers who make a submission without all of the necessary forms miss out on the advantages of the program and the reduction of otherwise applicable civil penalties for the non-filing. Moreover, failure to file the necessary information returns as part of the submission can leave the door open for the IRS to challenge the submission as not complete.

There are a litany of foreign information forms that come into play here. They almost always include FBARs, Forms 8938, and Forms 5471. However, tax professionals should be knowledgeable of other less common forms (e.g., Form 3520 or Form 8621, to name only a few).

- Computing the Title 26 Miscellaneous Penalty Incorrectly

There is, of course, a price for admission into the IRS’s Streamlined Filing Compliance Procedures. Generally, the taxpayer must submit six years of FBARs and three years of income tax returns (original or amended) and pay tax and interest. In addition, the taxpayer must generally pay a miscellaneous Title 26 penalty, which is five percent of certain foreign assets.

The certain foreign assets part is where tax professionals often go wrong. For example, I have seen tax professionals include in the penalty base foreign rental property (not held in an entity). This is not correct, and the taxpayer is paying too much for the penalty. Prior to making the submission, tax professionals should read the IRS’s instructions regarding applicable penalties carefully to ensure they are not hurting their clients.

Remedies for Taxpayers Who Receive Bad Advice

The above are only some of the mistakes I have seen vis-à-vis the IRS’s Streamlined Filing Compliance Procedures. In the event a tax professional messes up to such an extent that the taxpayer is damaged, the taxpayer likely will have various remedies to seek damages directly against the tax professional. The most common would be for the taxpayer to file a lawsuit for professional malpractice.

States recognize causes of action for professional malpractice. Generally, these laws require professionals to exercise a level of skill, care and diligence similar to those of other members of the profession under similar circumstances. And because professionals are held to a higher standard than others, these professionals must render work competently. Tax professionals that fail to provide services in line with these standards are liable for malpractice and damages to a taxpayer.

The malpractice action could conceivably relate to at least two aspects of the tax professional’s representation of the taxpayer. First, courts have held that tax professionals owe a duty to their clients to fully advise of the risks associated with taking a course of action. To the extent the client is harmed by the tax professional’s failure to do so, the taxpayer may recover damages for malpractice. See, e.g., Billings v. Clinic v. Peat Marwick Main & Co., 244 Mont. 324 (1990) (duty of CPA in examining tax and accounting considerations included duty to advise client of risks associated with proposed reorganization). Second, although courts have not held tax professionals to a perfect standard, tax professionals are required to comply with the standard of care of other tax professionals. Under this latter theory, if the taxpayer can show the tax professional failed to comply with this standard—for example, by failing to recognize a Form 3520 filing obligation—the taxpayer could also assert a malpractice claim.

In many cases, the measurement of damages will be for all injuries that are proximately caused by the defendant’s negligent conduct. Thus, the taxpayer should be able to recover the difference between his or her present economic condition and the condition that he or she would have been in absent the negligence. With respect to a botched submission under the IRS’s Streamlined Filing Compliance Procedures, damages would likely be the amount of civil penalties incurred by the taxpayer to the extent the taxpayer could prove that the civil penalties would not have been incurred with a successful submission.

Conclusion

The IRS’s Streamlined Filing Compliance Procedures present major challenges and potential traps to taxpayers and tax professionals who are unfamiliar with its requirements. Taxpayers should choose carefully who they select to make a submission, looking closely at the tax professional’s credentials and experience in these matters. To the extent the tax professional makes a bad submission under these procedures, taxpayers should consult with an attorney to determine whether they have a viable malpractice claim against the tax professional.

Streamlined Filing and Voluntary Disclosure Attorneys

Freeman Law’s international and criminal tax attorneys have advised hundreds of taxpayers in streamlined filings and voluntary disclosures. Our team can help businesses and individuals manage critical tax risks and make sense of complex international tax compliance rules. Schedule a consultation or call (214) 984-3000 to discuss your streamlined filing or voluntary disclosure concerns or questions.