No one wants to pay federal taxes. And this truism applies more so with respect to federal tax penalties. Accordingly, clients often call upon their tax professionals to request waiver or abatement of any asserted penalties.

Chief among the waiver or abatement defenses is so-called “reasonable cause.”[i] To show reasonable cause, a taxpayer must show that he or she exercised ordinary business care and prudence in determining a tax obligation but nevertheless was unable to comply with the tax obligation.[ii] Because taxpayers routinely rely upon their tax advisers, federal courts have for some time now recognized a reasonable cause defense for reliance on a tax professional.

Contrary to popular belief, the usage of a tax professional to prepare a tax return is not a get-out-of-jail free card. Rather, taxpayers have the burden of proof to show that reliance on the tax adviser was reasonable under the circumstances. In many cases, this requires a taxpayer to meet all three requirements under the United States Tax Court’s decision in Neonatology. This article discusses the Neonatology requirements and the professional reliance defense.

Federal Tax Penalties

Federal tax penalties have been in our federal tax system since the Civil War.[iii] Today, the Internal Revenue Code of 1986, as amended (the “Code”), contains over 100 different types of federal tax penalties. According to the IRS, all of these tax penalties have a common thread: they were enacted by Congress to promote voluntary compliance with our federal tax system. Therefore, taxpayers are generally not surprised to learn that certain types of conduct are subject to penalties, such as late filing and late payment of tax.

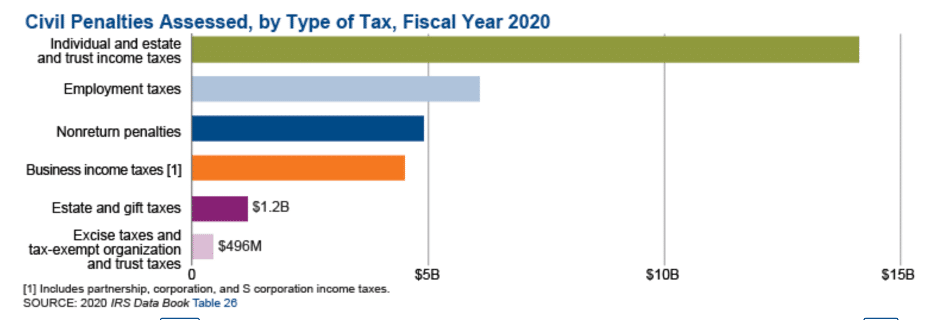

These tax penalties are here to stay. Aside from promoting voluntary compliance, federal tax penalties provide a significant source of revenue for the United States government. For example, in fiscal year 2020, the IRS assessed over $31 billion of civil penalties against taxpayers, as shown in the below graph:

Because these numbers were during the height of the COVID-19 pandemic, taxpayers can expect a steady trend upwards in the IRS’s imposition of tax penalties in the foreseeable future.

The Neonatology Factors

On July 31, 2000, the Tax Court issued its division opinion in Neonatology Associates, P.A. v. Commissioner.[iv] In that test case, the IRS asserted deficiencies against several taxpayers for their participation in certain employee welfare benefit plans. The IRS also proposed accuracy-related penalties against the taxpayers.

The Tax Court held in favor of the IRS on the issue of the deficiencies. Accordingly, the Tax Court turned its attention to whether the taxpayers should be liable for accuracy-related penalties for negligence or intentional disregard of rules or regulations.[v] On this issue, the taxpayers contended that they were not liable for accuracy-related penalties because they relied upon their tax professionals for their reporting positions. After reviewing relevant law, the Tax Court set forth a three-pronged test that taxpayers must meet to show reasonable cause reliance on a tax professional. These three prongs are:

- Whether the adviser was a competent professional who had sufficient expertise to justify reliance?

- Whether the taxpayer provided necessary and accurate information to the adviser?

- Whether the taxpayer actually relied in good faith on the adviser’s judgment?

Generally, taxpayers who satisfy all three requirements can avoid a federal tax penalty due to reliance on a tax professional. But a word of caution is necessary. First, taxpayers cannot unconditionally rely on a tax professional’s advice. More specifically, taxpayers have a duty to review the prepared tax return and to identify any line items or reported matters that are obviously incorrect, based on the taxpayer’s knowledge of their own tax affairs.[vi] Second, the Neonatology test does not apply to certain tax reporting obligations. For example, a taxpayer cannot reasonably rely on a tax professional to file an individual income tax return.

Competent Tax Professional

The first hurdle that a taxpayer must satisfy under Neonatology relates to the experience and competence level of the tax professional. Key here is whether the taxpayer’s reliance was justifiable. As noted by the Tax Court in recent years, “[t]here is no precise threshold of competence that a tax adviser must have to satisfy a taxpayer’s reliance. Rather, our practical test looks for expertise in the context of the facts of each case.”[vii] Notably, this factor does not necessarily hinge on whether the tax professional in question was qualified—rather, the Tax Court tends to look at whether the tax professional’s credentials gave an appearance to the taxpayer that he or she was qualified and competent..[viii]

Taxpayers who have utilized CPAs, EAs, attorneys, and accountants with many years of experience can generally meet this prong. For example, the Tax Court has held that an accountant with an MBA degree who was a full-time return preparer and EA had the requisite degree of competence and skill to justify reliance.[ix] Conversely, those with little or no actual tax return or tax experience will generally not qualify, particularly if the legal or tax matters are more complex.[x]

Necessary and Accurate Information

The second requirement under Neonatology requires the taxpayer to show that he or she provided the tax adviser with all necessary information to make the tax determination. In addition, this prong requires the taxpayer to provide the tax adviser with accurate information. Taxpayers cannot “fail[ ] to disclose a fact that [they] know[ ], or reasonably should know, to be relevant to the proper tax treatment of an item.”[xi] However, taxpayers are not required to provide details to the tax adviser to the extent a taxpayer would not reasonably know such information was relevant.[xii]

An example may be helpful here. Assume that a taxpayer has an ownership interest in a company in a foreign country but fails to disclose that interest to his or her tax professional. Assume further that the IRS asserts penalties against the taxpayer for failure to timely file a Form 5471. If the taxpayer attempts to argue that he relied on his tax professional, the taxpayer will fail to meet the necessary and accurate Neonatology prong because the taxpayer never notified the tax professional of the ownership interest.[xiii] The logic here is that a tax professional cannot give tax advice on matters that are unknown to them.

Good-Faith Reliance

The final requirement under Neonatology is that the taxpayer must show that he or she actually relied on the tax professional in good faith. Taxpayers often meet this prong by showing long-term relationships with their professional advisers, which can strongly support a good-faith reliance finding.[xiv] In addition, the taxpayer’s “experience, knowledge, and education” are important factors to determine whether the taxpayer had good faith in relying on the advice.[xv]

On the other hand, taxpayers will usually fail this prong if they relied on a tax adviser who had an apparent conflict of interest. Under this rule, taxpayers who rely on promoters will often be unable to use a reliance defense.[xvi] Similarly, taxpayers are barred from using the defense if the taxpayer is provided “too good to be true” opinions regarding a tax matter.[xvii]

Foreign Information Returns

Although the Neonatology test is commonly used to negate accuracy-related and fraud penalties, a recent decision from the Tax Court demonstrates that Neonatology can provide useful to taxpayers in other contexts as well. In Kelly v. Commissioner,[xviii] the taxpayer formed a Cayman Islands company. Because the taxpayer had sole ownership in the foreign company, which was treated as a corporation for United States tax purposes, the taxpayer had Form 5471 filing obligations. The taxpayer failed to timely file Forms 5471, and the IRS asserted additional tax and penalties against the taxpayer.

At trial, the taxpayer argued that he had reasonable cause for not filing the Forms 5471 on time. Specifically, he argued that he had relied upon his CPA tax-return preparer to advise him on any international reporting requirements. The Tax Court cited to Neonatology and found that the taxpayer had shown reasonable cause reliance on a tax professional as a defense. In finding in favor of the taxpayer, the Tax Court noted that the taxpayer had properly provided his CPAs with information to put them on notice that he had ownership of a company in a foreign country. And although the CPAs erred in not timely filing the Forms 5471, the Tax Court concluded that the taxpayer was not required to second guess the decisions of the CPAs.

Conclusion

Reliance on a tax professional will continue to be a potent reasonable cause defense for taxpayers. Because the IRS and federal courts carefully scrutinize all relevant facts and circumstances, however, taxpayers should be careful in ensuring that they can satisfy their three-prong burden under Neonatology. A failure to meet any one of the three requirements under Neonatology is fatal to a successful penalty defense.

Expert Penalty Defense Attorneys

Need assistance with IRS penalty defense? Each individual civil penalty has different penalty defenses. It is important to raise the proper penalty defenses with the IRS at the appropriate time. Freeman Law can help you navigate these complex issues. We handle all types of cases including civil, failure-to-file and failure-to-pay, accuracy-related, fraud, tax shelters, international tax, employment tax, and trust fund recovery penalties. Schedule a consultation or call (214) 984-3000 to discuss your tax concerns.

[i] There are a variety of other defenses, such as statutory exceptions, administrative waivers, and correction of IRS service errors, to name a few.

[ii] Treas. Reg. § 1.6664-4(b)(1).

[iii] Office of Tax Pol’y, Dep’t of the Treasury, Report to the Congress on Penalty and Interest Provisions of the Internal Revenue Code (1999).

[iv] 115 T.C. 43 (2000).

[v] See I.R.C. § 6662.

[vi] Walton v. Comm’r, T.C. Memo. 2021-40, and collected cases; see also Weiderman v. Comm’r, T.C. Memo. 2020-109 (“Simply employing tax return preparers for the years at issue does not permit petitioners to avoid accuracy-related penalties.”).

[vii] Rogerson v. Comm’r, T.C. Memo. 2022-49.

[viii] 106 Ltd. v. Comm’r, 136 T.C. 67, 77 (2011), aff’d, 684 F.3d 84 (D.C. Cir. 2012).

[ix] Thousand Oaks Residential Care Home I, Inc. v. Comm’r, T.C. Memo. 2013-10.

[x] Pankratz v. Comm’r, T.C. Memo. 2021-26.

[xi] Treas. Reg. § 1.6664-4(c)(1)(i).

[xii] Est. of Morgan v. Comm’r, T.C. Memo. 2021-104 (citing CNT Inv’rs, LLC v. Comm’r, 144 T.C. at 228)).

[xiii] See, e.g., Flume v. Comm’r, T.C. Memo. 2020-80.

[xiv] Schwalbach v. Comm’r, 111 T.C. 215, 230-31 (1998); Skolnick v. Comm’r, T.C. Memo. 2021-139.

[xv] Hussey v. Comm’r, 156 T.C. 170, 183 (2021) (citing Treas. Reg. § 1.6664-4(b)(1)).

[xvi] Campbell v. Comm’r, T.C. Memo. 2020-41, and cases cited therein; Avrahami v. Comm’r, 149 T.C. 144 (2017); see also McNeil v. Comm’r, T.C. Memo. 2017-206 (“An independent advisor is unburdened with a conflict of interest and is not a promoter of the transaction.”).

[xvii] McNeil, supra.

[xviii] T.C. Memo. 2021-76.