It’s that time of year again. Various football teams scramble at the end of the regular season for a chance at the playoffs. And with each game’s conclusion spectators get an updated “playoff picture” with respect to where each team stands. In that same spirit, as we begin 2022, it is helpful to see a “playoff picture” of the current legal landscape for FBAR violations, specifically non-willful violations. Certainly, football playoff games are more eventful than federal court decisions; however, such court decisions are no less impactful, particularly for those taxpayers with unreported foreign accounts.

FBARs, Generally

The Bank Secrecy Act, passed by Congress in 1970, authorized the Department of Treasury to collect certain information from U.S. persons who have financial interests in or signature authority over financial accounts maintained with financial institutions outside the United States. Further, in April 2003, the Financial Crimes and Enforcement Network (“FinCEN”) delegated its enforcement authority with respect to FBARs to the Internal Revenue Service.[1]

U.S. persons must file a FinCEN Form 114, Report of Foreign Bank and Financial Accounts (“FBAR”), if the aggregate maximum values of the foreign financial accounts exceed $10,000 at any time during the calendar year. For purposes of FBAR reporting, a “U.S. person” includes a citizen or resident of the United States, an entity created or organized in the United States or under the laws of the United States (including corporations, partnerships, and limited liability companies), a trust formed under the laws of the United States, or an estate formed under the laws of the United States.[2]

31 U.S.C. § 5321

A U.S. person may be subject to certain civil and/or criminal penalties for FBAR reporting violations. 31 U.S.C. § 5321(a)(5) states, in part, as follows:

(5) Foreign financial agency transaction violation.—

(A) Penalty authorized.—

The Secretary of the Treasury may impose a civil money penalty on any person who violates, or causes any violation of, any provision of section 5314.

(B) Amount of penalty.—

Except as provided in subparagraph (C), the amount of any civil penalty imposed under subparagraph (A) shall not exceed $10,000.[3]

Section 5321 also addresses penalties for willful violations, see 31 U.S.C. § 5321(a)(5)(C); however, this article is focused on the current landscape for non-willful violations and, specifically, what constitutes a violation.

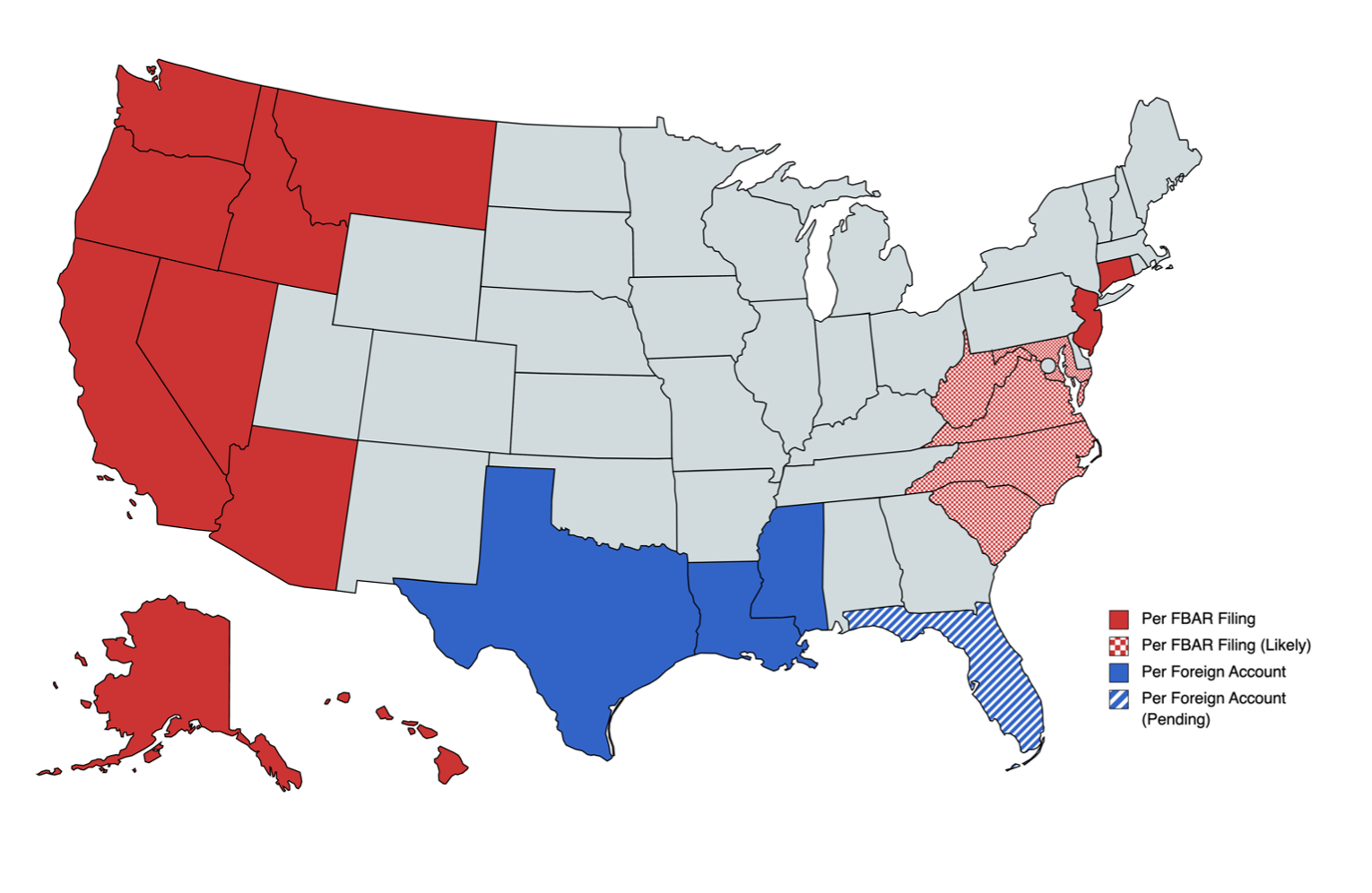

Current FBAR Violations Map

FBAR Penalties

FBAR Penalties

Breakdown of Major Court Decisions

The following federal cases addressed the issue (either directly or in dictum) of whether non-willful FBAR violations apply per FBAR filing or per foreign account. Each decision was issued in 2021 (save one), and the majority decisions occurred during the fourth quarter.

- United States v. Boyd, 991 F.3d 1077 (9th Cir. Mar. 24, 2021)—Largely setting the 2021 landscape for FBAR violations, Boyd squarely addressed the meaning of “violation” and held it applied per FBAR filing. Accordingly, this decision is reflected in solid red in each state that comprises the Ninth Circuit Court of Appeals. For more information and discussion on this decision, see our previous Insight Blogs: Good News for the Taxpayer with Foreign Accounts—United States v. Boyd and Recent FBAR Case Allows Multiple Penalties for Single Failure to File FBAR.

- United States v. Bittner, 19 F.4th 734 (5th Cir. Nov. 30, 2021)—Bittner also directly addressed the meaning of “violation” and decided a non-willful violation applied per account, putting the Fifth Circuit directly at odds with the Ninth Circuit. This decision is reflected in solid blue in each state that comprises the Fifth Circuit Court of Appeals. For more information and discussion on this decision, see our previous Insight Blogs: The Largest Non-Willful FBAR Penalty Case Ever?, Court Strikes Down Largest Non-Willful FBAR Penalty Ever, and Why Taxpayers in Louisiana, Texas, and Mississippi Should Consider the IRS’s Streamlined Compliance Procedure Program Now.

- United States v. Horowitz, 978 F.3d 80 (4th Cir. Oct. 20, 2020)—As noted by the Fifth Circuit in Bittner, the Fourth Circuit has suggested that it would take a per-FBAR-filing view, rather than a per-foreign-account view. See Horowitz, 978 F.3d at 81 (“[a]ny person who fails to file an FBAR is subject to a maximum civil penalty of not more than $10,000[.]”). Accordingly, this dictum is reflected in a checkered, red pattern in each state that comprises the Fourth Circuit Court of Appeals.

- United States v. Solomon, No. 20-82236-CIV, 2021 WL 5001911, at *1 (S.D. Fla. Oct. 27, 2021)—Like Bittner(albeit a month prior), the U.S. District Court for the Southern District of Florida determined that non-willful FBAR penalties should be applied per foreign account. The Solomon decision has been appealed, so it remains to be seen how the Eleventh Circuit will rule (given the history of Boyd and Bittner). Thus, the map currently reflects a striped, blue pattern in the state of Florida—although any decision by the Eleventh Circuit on this issue will also affect Alabama and Georgia. For more information and discussion on this decision, see our previous Insight Blog: Beware of Your FBAR Obligations—U.S. v. Solomon.

- United States v. Giraldi, No. 20-2830 (SDW) (LDW), 2021 WL 1016215, at *1 (D.N.J. Mar. 16, 2021)—Over a week before the Ninth Circuit’s decision in Boyd, the District Court for the District of New Jersey also held that non-willful FBAR penalties should apply per FBAR filing. Accordingly, this decision is reflected in solid red in the state of New Jersey.

- United States v. Kaufman, No. 3:18-CV-00787 (KAD), 2021 WL 83478, at *1 (D. Conn. Jan. 11, 2021)—Like Boyd and Giraldi, the District Court for the District of Connecticut decided that non-willful violations should apply per FBAR filing, not per foreign account. Accordingly, this decision is reflected in solid red in the state of Connecticut. For more information and discussion on this decision (as well as others), see our previous Insight Blog: Do FBAR Penalties Survive Death? A Texas Court Says “Yes”.

Conclusion

It is apparent that various federal courts have taken divergent views on the term “violation” with respect to Section 5321—whether it should apply only to each taxpayer’s FBAR filing or whether it should apply to any foreign account held by a taxpayer. The Boyd and Bittner decisions create a direct federal appellate split on the issue. Additionally, the Solomon case will provide the Eleventh Circuit the opportunity to provide input on this issue. Regardless, the legal landscape for FBARs (and non-willful violations) is still in flux and the subject of much discussion. Whether this issue is ultimately addressed by the U.S. Supreme Court or by a change in the laws by Congress remains to be seen. However, one thing is certain: taxpayers should be mindful of their FBAR obligations in this current environment.

FBAR Penalty Defense Attorneys

FBAR penalty defense requires a proactive representation and a deep knowledge of the nuances of FBAR compliance and its defenses. Freeman Law represents clients with offshore tax compliance disputes involving FBAR penalties and international information return penalties. Failing to file an FBAR can give rise to significant penalties, including a non-willful penalty and willful FBAR penalty. The risks of tax and reporting non-compliance have never been more real and the threat of international penalties, particularly FBAR penalties, has never been more clear. Schedule a consultation or call (214) 984-3000 to discuss your FBAR penalty concerns or questions.

[1] See IRS FBAR Reference Guide.

[2] Id.

[3] 31 U.S.C. § 5321(a)(5)(A)-(B)(i). It should also be noted that the penalties prescribed by this section are indexed for inflation. Further, the penalty described above is for non-willful violations.